What are the 5 Laws of Wealth Creation?

Article Licenses: CA, DL, unknown, unknown, unknown

Advisor Licenses:

Compliant content provided by Adviceon® Media for educational purposes only.

Here are five wealth creation principles that will remain true forever.

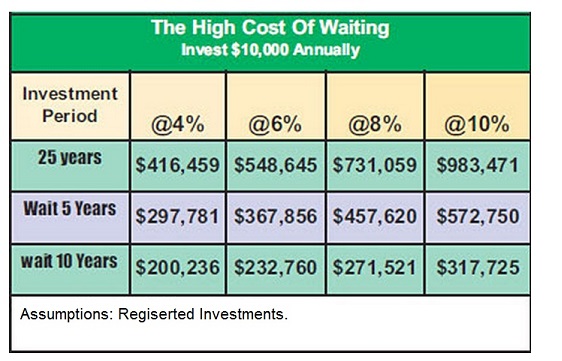

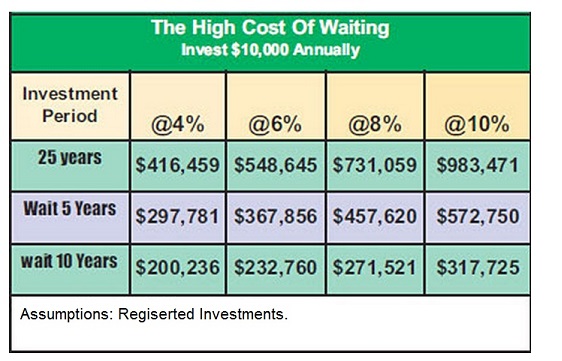

1. You must get time on your side by investing early in your lifetime. Time adds value to money. Delayed investing shortens your time, which increasingly requires the compensation of higher and higher returns to meet your retirement goals. Examine the following graph to see how time affects your investment growth.

Source: Financium

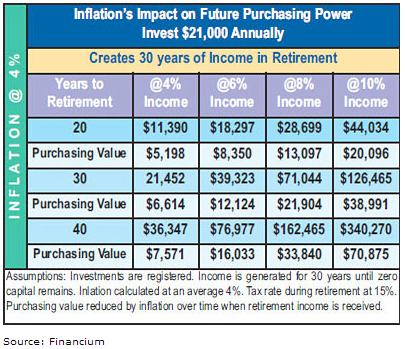

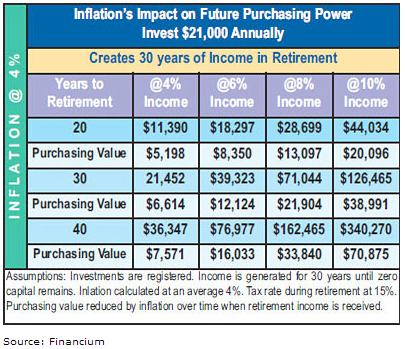

2. Your investment growth must exceed inflation. If you earn 8% on a $10,000 investment per year, over 20 years with inflation at an average 4% your actual investment will grow to $457,620, but your actual buying power in the future will only be $208,852 (while your money is growing, inflation is increasing the cost of goods). The graph below indicates how inflation might affect your investment’s future buying power.

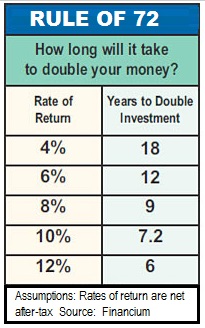

3. Algebraic factors apply to investing. You can indicate your multiple on capital invested by applying mathematical rules, factoring in both time and rate of return.

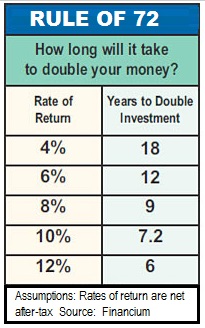

· Double Your Money: Rule of 72. To find out how many years it will take to double your money, divide 72 by your average annual rate of return.

· Triple Your Money: Rule of 113. Divide 113 by your average annual rate of return to see how many years it will take to triple your invested money.

4. Taxation can reduce your investment returns.

Every dollar of tax retained through tax-planning is a dollar earned.

· Deduct what you can against your income. Business owners have the advantage of deducting many operating expenses from their revenues.

· Contribute to registered investments. For both business owners and employees, registered investments may allow deductions against earned income and may offer tax-deferral.

· Defer as much taxation as possible. The beauty of registered investments is that they allow some tax planning benefits depending on your income, and capital available to invest.

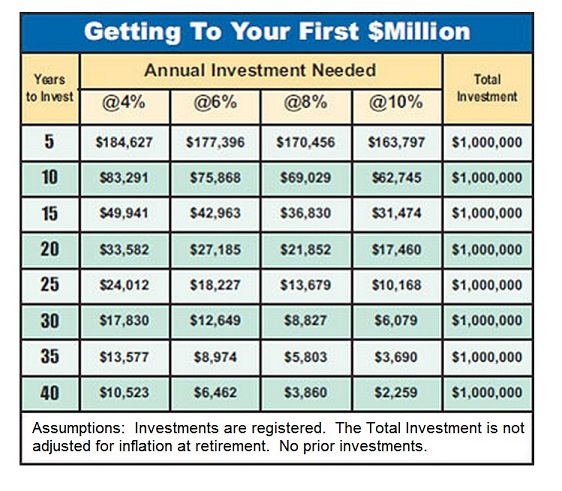

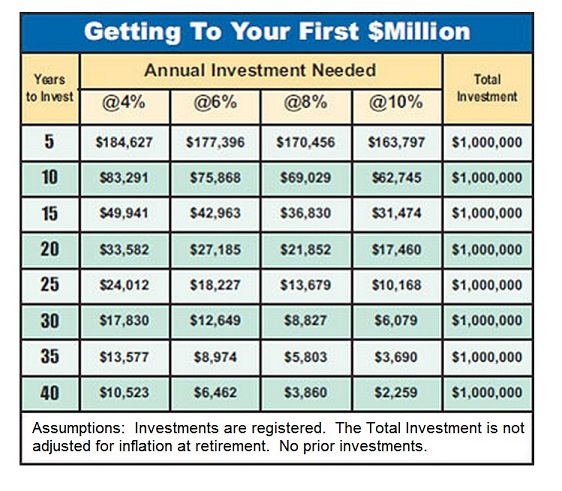

5. Become an active investor. It is important to begin investing early in life when you get your first job or begin your career. By beginning early, you can have the above stated mathematical laws of doubling and tripling your money working for you. Many wait far too long before investing and lose the value that time can add to a good investment portfolio by increasing the future accumulation of investment money.

The following table will let you know just how much you will need to invest to accumulate one million dollars.

Source: Financium

Publisher's Copyright & Legal Use Disclaimer

All articles are a legal copyright of Adviceon®Media and are for educational

purposes only. The particulars contained herein were obtained from sources

which we believe are reliable, but are not guaranteed by us and may be

incomplete. This website is not deemed to be used as a solicitation in a

jurisdiction where this representative is not registered. This content is not

intended to provide specific personalized advice, including, without

limitation, investment, insurance, financial, legal, accounting or tax

advice; and any reference to facts and data provided are from various sources

believed to be reliable, but we cannot guarantee they are complete or

accurate; and it is intended primarily for Canadian residents only, and the

information contained herein is subject to change without notice.

References in this website to third party goods or services should not be

regarded as an endorsement, offer or solicitation of these or any goods or

services. Always consult an appropriate professional regarding your particular

circumstances before making any financial decision. The information provided

is general in nature and should not be relied upon as a substitute for advice

in any specific situation. The publisher does not guarantee the accuracy and

will not be held liable in any way for any error, or omission, or any

financial decision.

Life Insurance and Segregated Funds Disclaimer

Life Insurance policies vary according to contract terms. Please read any

Life Insurance policy contract provided, or the segregated fund summary

information folder prospectus before the time of purchase. Full details of

coverage, including limitations and exclusions that apply, are set out in

the policy of insurance. Commissions, trailing commissions, management fees

and expenses may be associated with segregated fund investments which may

not be guaranteed and their market value changes daily and past performance

is not indicative of future results. A description of the key features of a

life insurance policy, a segregated fund; and any applicable individual

variable annuity contract is contained in information provided by the

company from which it is purchased. Talk to your advisor before making any

financial decision. For specific situations, advice should be obtained from

the appropriate legal, accounting, tax or other professional advisors. The

information provided is accurate to the best of our knowledge as of the date

of publication and is general in nature, intended for educational purposes

only, and should not be relied upon as a substitute for advice in any

specific situation. For specific situations, advice should be obtained from

the appropriate legal, accounting, tax or other professional advisors.

Rules and their interpretation may change, affecting the accuracy of the

information.