What could I miss doing that could ruin my retirement?

Article Licenses: CA, unknown, unknown

Advisor Licenses:

Compliant content provided by Adviceon® Media for educational purposes only.

Perhaps you haven’t started investing regularly, or the amount you allocate is not enough to reach your retirement goals. Here are a few of the things people are not doing that can ruin otherwise good investment goals.

Not viewing debt as negative investment earnings. If you are paying 18% interest on a credit card while earning 8% in an investment, that immediately places you in a 10% loss position per dollar compared. Moreover, where else can you get such a guarantee on your investment return, as you can by investing in your debt repayment? By paying off $5,000 over one year, you’ll earn $900 risk-free and you won’t have to pay that with after-tax dollars ever again.

Unsecured credit card debt can kill a once-healthy budget, while substantially reducing your income. And opportunities can suffer when your cash flow is crippled by debt. It is harder to solve the need for emergency cash if you are debt-ridden.

Especially look at paying down debts that carry interest that cannot be written off as you are paying for both the principal and the interest with after-tax dollars.

Not putting money away into an emergency fund. If an emergency arises you should be able to access a simple bank account to cover up to three to six months’ worth of living expenses such as your rent or mortgage, food, debt repayment, car payments, etc. Consider using a money market fund for this savings plan.

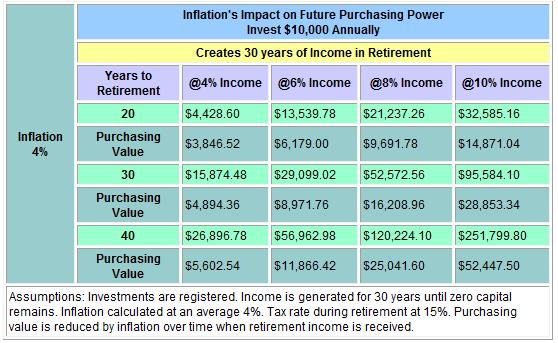

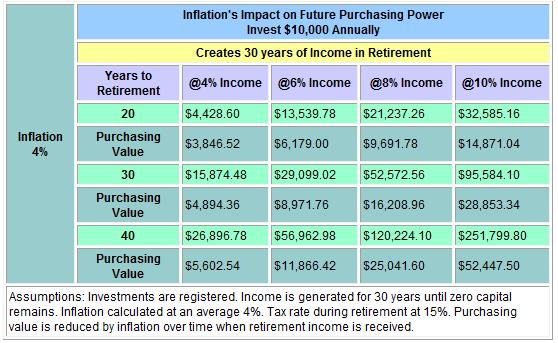

Not assessing your retirement time horizon. You can analyze what you will need to invest annually, by running calculations to see if you will have sufficient income to live on. Confer also with your advisor about how you can get there over your remaining employment years, by investing with a clear vision.

Not assessing the impact of inflation on your retirement income. Refer to this table to see how inflation can affect your retirement plan.

Planning for your dependants. Make sure you have sufficient life insurance to pay off your total debts such as: credit card balances, car loans, IOUs, and any business-related debt. Incorporate this with sufficient coverage to provide future income for your dependants. This is especially necessary if your debt exceeds your annual income as it does for the average Canadian household where debt runs at 150% of income. Source: The Vanier Institute of the Family, February 2011

Publisher's Copyright & Legal Use Disclaimer

All articles are a legal copyright of Adviceon®Media and are for educational

purposes only. The particulars contained herein were obtained from sources

which we believe are reliable, but are not guaranteed by us and may be

incomplete. This website is not deemed to be used as a solicitation in a

jurisdiction where this representative is not registered. This content is not

intended to provide specific personalized advice, including, without

limitation, investment, insurance, financial, legal, accounting or tax

advice; and any reference to facts and data provided are from various sources

believed to be reliable, but we cannot guarantee they are complete or

accurate; and it is intended primarily for Canadian residents only, and the

information contained herein is subject to change without notice.

References in this website to third party goods or services should not be

regarded as an endorsement, offer or solicitation of these or any goods or

services. Always consult an appropriate professional regarding your particular

circumstances before making any financial decision. The information provided

is general in nature and should not be relied upon as a substitute for advice

in any specific situation. The publisher does not guarantee the accuracy and

will not be held liable in any way for any error, or omission, or any

financial decision.

Life Insurance and Segregated Funds Disclaimer

Life Insurance policies vary according to contract terms. Please read any

Life Insurance policy contract provided, or the segregated fund summary

information folder prospectus before the time of purchase. Full details of

coverage, including limitations and exclusions that apply, are set out in

the policy of insurance. Commissions, trailing commissions, management fees

and expenses may be associated with segregated fund investments which may

not be guaranteed and their market value changes daily and past performance

is not indicative of future results. A description of the key features of a

life insurance policy, a segregated fund; and any applicable individual

variable annuity contract is contained in information provided by the

company from which it is purchased. Talk to your advisor before making any

financial decision. For specific situations, advice should be obtained from

the appropriate legal, accounting, tax or other professional advisors. The

information provided is accurate to the best of our knowledge as of the date

of publication and is general in nature, intended for educational purposes

only, and should not be relied upon as a substitute for advice in any

specific situation. For specific situations, advice should be obtained from

the appropriate legal, accounting, tax or other professional advisors.

Rules and their interpretation may change, affecting the accuracy of the

information.